MYOB Reporting, GST & BAS Course

Course Topics

Once you have completed your bank reconciliation most of the hard work is done. If you have entered each transaction into the correct account (from the chart of accounts) and it matches your bank statements then all you need to do is extract the data you are looking for.

Once you have completed your bank reconciliation most of the hard work is done. If you have entered each transaction into the correct account (from the chart of accounts) and it matches your bank statements then all you need to do is extract the data you are looking for.

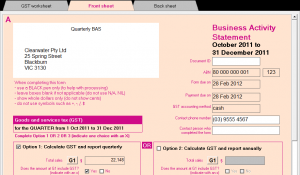

If you have allocated the correct tax codes to each transaction and entry you will find that the GST payable and collected will be automatically reported, all you need to do is then transfer this information to your ATO document (or online via the Business Portal)

MYOB Financial Reports

Most of the reports you need for your business are standard for the accounting industry and include reports to demonstrate your assets vs liabilities (Balance Sheet), CashFlow and Profit & Loss (income and expenditure). If your source data is entered correctly, you’ll learn how MYOB takes that data and produces the reports for you. If you need to work with those numbers or produce forecasts you can export to a spreadsheet program like Microsoft Excel to modify as you please.

- Balance Sheet

- Profit and Los

- Cashflow

Who should do this MYOB course?

The MYOB Reporting, GST and BAS course teaches you how to get the useful information that has been entered into your system once it has been setup, data has been entered and it has been reconciled to match the real world (ie you bank account).

This course provides practical tasks to show you were the information is stored, where to get the information you need for your BAS report and other reporting features that are often wanted by banks and other financial institutions like Balance Sheet, Profit and Loss statements.

Although this course can be completed on a stand along basis it is best completed as part of the course sequence to allow you to cement the elementary day-to-day skills and see how the information ends up at the reporting end which is what the ATO wants.

What you’ll learn:

- GST reports,

- How to complete your BAS using MYOB’s BASlink

- Setup your BAS Info and

- Backup the completed BAS report for that period.

How long does this MYOB course take to complete?

When we operated training centres in Sydney this course would take 1 short day. Online you can take as long as you need and progress at your own pace.

MYOB Courses Information Price and Ordering MYOB Course 5 Payroll